Akord

Akord je souzvuk nejméně tří tónů různé výšky.

Zahrajeme-li tóny akordu po sobě jako melodii, vzniká akord melodický - říkáme,

že akord hrajeme v melodickém rozkladu. Zahrajeme-li tóny akordu současně, jedná se o akord harmonický.

Základem hudebního doprovodu jsou dvě skupiny akordů: akordy

durové a mollové. Akord durový (tvrdý) vnímáme obvykle jako veselý, akord mollový (měkký) vnímáme zpravidla jako smutný a zadumaný.

Durové akordy

Půltónová šablona: 0 - 4 - 7

| Dur akord | Tóny, ze kterých se skládá | ||

|---|---|---|---|

| Cdur | C | E | G |

| C#dur | C# | F | G# |

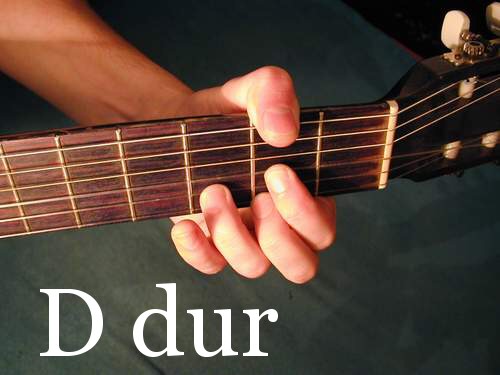

| Ddur | D | F# | A |

| D#dur | D# | G | B |

| Edur | E | G# | H |

| Fdur | F | A | C |

| F#dur | F# | B | C# |

| Gdur | G | H | D |

| G#dur | G# | C | D# |

| Adur | A | C# | E |

| Bdur | B | D | F |

| Hdur | H | D# | F# |

Molové akordy

Půltónová šablona: 0 - 3 - 7

| mol akord | Tóny, ze kterých se skládá | ||

|---|---|---|---|

| Cmol | C | D# | G |

| C#mol | C# | E | G# |

| Dmol | D | F | A |

| D#mol | D# | F# | B |

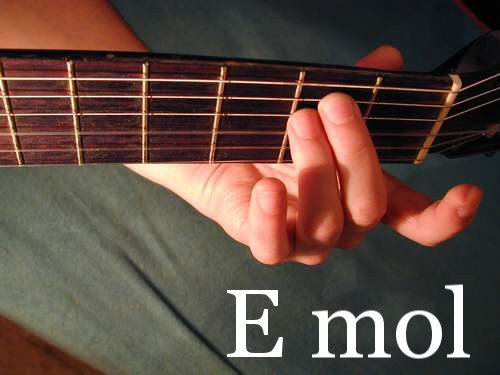

| Emol | E | G | H |

| Fmol | F | G# | C |

| F#mol | F# | A | C# |

| Gmol | G | B | D |

| G#mol | G# | H | D# |

| Amol | A | C | E |

| Bmol | B | C# | F |

| Hmol | H | D | F# |

Sedmičkové durové akordy

Půltónová šablona: 0 - 4 - 7 - 10

| Dur akord | Tóny, ze kterých se skládá | + sedmička | ||

|---|---|---|---|---|

| Cdur | C | E | G | B |

| C#dur | C# | F | G# | H |

| Ddur | D | F# | A | C |

| D#dur | D# | G | B | C# |

| Edur | E | G# | H | D |

| Fdur | F | A | C | D# |

| F#dur | F# | B | C# | E |

| Gdur | G | H | D | F |

| G#dur | G# | C | D# | F# |

| Adur | A | C# | E | G |

| Bdur | B | D | F | G# |

| Hdur | H | D# | F# | A |

F dur

D moll

C dur

C7

A moll

G dur

G7

E moll

D dur

D7

H moll

A dur

- bez toho malíčku

E dur

- bez malíčku

E7

H dur

H7

F# dur

F# 7

G moll

G dim

Komentáře

Přehled komentářů

The Irresistible Squishies Craze: Within this Cute Plush Plaything Obsession

SquishiePillows have get an undisputed plaything rage thanks to their amazingly silken surface plus cute grinny-faced cushy models. This round, cushiony filled animals have won above kids and full-grown collectors common as the hottest new squishy toy mode.

A Genesis Story: How Squishmallows Arrived to Life

https://click4r.com/posts/g/13771921/

https://tranberg-olsen.technetbloggers.de/an-inevitable-ascent-from-squishies-1703623289

https://anotepad.com/notes/b7dgbwrd

https://click4r.com/posts/g/13769544/

https://pastelink.net/he75ovxa

A beginnings from Squishmallows can be traced for toy business specialists in Kellytoy. Within 2017, them looked for make one brand-new class from super-soft plush toys centered on comfort plus sweetness. After twelvemonths from experimenting among premium super-soft synthetic fibers coat fabrics and proficient filling ratios, these in the end achieved the perfect "smoosh" density and huggability they have been searching for.

Christening this inventions "SquishiePillows", they unveiled a line of jovial creature cushion friends at toy fairs in 2018 for immediate applause. The progress arrived in 2019 when viral community multimedia system whir from devotees featuring the playthings kicked this Squishies sensation in tall apparatus.

Major Parts Lurking behind this Squishmallows Recipe

Several major factors crafted this runaway achievement Squishmallows savor as both a worldwide toy label and bang culture sensation:

https://telegra.ph/The-Unstoppable-Rise-from-Squishies-12-26-7

https://squareblogs.net/bechvaughan88/the-unstoppable-rise-from-squishies

https://anotepad.com/notes/dbnxbdp8

https://anotepad.com/notes/68ewt66b

https://pastelink.net/1q285q91

Texture Charm - A satisfyingly glasslike, dense cushy material furnish incomparable alleviating tactile joy for squeezing plus embrace meetings alike.

Sweet Role Designs| Between their snug rotund bodies to content grinny expressions, the enjoyable appearances connect uncontrollable fashion among beguiling identity.

Cheerful Isolation - At instants from global uncertainty, the boosting zany nature allow comfort through simple sport plus amassing passion.

Society Link| Vibrant devotee groundworks came out on communal systems united from joint collecting passion and thick oganized crime to different sweet identities.

Continuous New Issues| Small exclusives impel urgency although brand-new motive drops plus capsule series maintain continuous pursuit.

https://zenwriting.net/malling27noonan/the-irresistible-rise-from-squishmallows

https://anotepad.com/notes/k4mycjrg

https://pastelink.net/wb1l8h0o

https://squareblogs.net/solis03mahmood/the-irresistible-rise-from-squishmallows

https://www.tumblr.com/rasmussen69booker/737867363180003328/an-inevitable-rise-of-squishmallows

Reviewing the Broad Squishmallow Plush Environment

Among practically many choices and enumerating, this range from this Squishmallows lineup grip exponentially growing. Probing over essence everyday collections together with restricted jogs plus collaborations uncovers this accurate scale of the super-viral squishy toy sign.

Gauge Productions| This widely freed possibilities become visible yearly across leading retailers in one arc of colors, creatures and dimensions.

Seasonal Editions - Joyous limited adaptation jogs for events like Halloween, Christmas, Resurrection Sunday, plus Valentine's Day. Outside center choices, formerly gone these disappear perpetually stoking demand. A few can unite this essence league provided that renown leaks adequately nevertheless.

Inovativní X-GPTWriter: moje osobní zkušenosti a doporučení

(Lackysoony, 27. 12. 2023 23:49)

Dobrý den!

Slyšeli jste někdy o X-GPT Writer: generátor jedinečného obsahu podle klíčových slov založených na Neuroseti chatgpt?

Já také ne, dokud mi nebylo doporučeno automatizovat rutinní úkoly tímto softwarem, chci říct jedno! Dlouho jsem tomu nemohl uvěřit.,

že ChatGPT je tak výkonný produkt, pokud je aplikován současně ve streamování, se systémem X-GPT Writer.

Myslel jsem, že je to jen nástroj, byl levný, přítel dal slevový kupón 40%:

94EB516BCF484B27

podrobnosti, kde jej zadat, jsou uvedeny na webu:

https://www.xtranslator.ru/x-gpt-writer/

Začal zkoušet, šťourat, koupil 50 chatgpt účtů za nízké ceny a dostal se!

Nyní snadno generuji a spouštím 3-4 nové stránky týdně, dávkově unikalizuji celé složky a dokonce vytvářím obrázky,

s neurosítí ChatGPT a X-GPT Writer.

Za vyzkoušení stojí přátelé, Je tam demo, vše je zdarma, nebudete litovat)

Hodně štěstí!

Секреты создания контента с ChatGPT

ChatGPT для автоматической генерации текстов

Эффективное использование ChatGPT для контент-стратегии

ChatGPT как инструмент для генерации контента

ChatGPT в качестве синонимайзера текста

X-GPTWriter: лучший софт для создания текстов

ChatGPT и X-GPTWriter для уникальных текстов

Легкий способ создавать контент с X-GPTWriter

уникализатор текста через ChatGPT

ChatGPT и X-GPTWriter: новая эра контент-маркетинга

The Unstoppable Squooshmallows Frenzy: Inside the Adorable Soft Plaything Fixation

(WilliamFroca, 27. 12. 2023 22:17)

An Irresistible Squishies Sensation: Inside the Cute Soft Toy Obsession

SquooshyPlushPals have gotten a unquestionable toy rage because of their amazingly silken texture and lovable grinny-faced cushy forms. These here ball-shaped, puffy stuffed animals have captivated over little ones and full-grown gatherers alike as this hottest brand-new squishy toy trend.

A Origin Story: How Squishies Came for Life

https://telegra.ph/An-Inevitable-Rise-of-Squishies-12-26-3

https://strange-mackinnon-2.blogbright.net/an-inevitable-ascent-from-squishies-1703664296

https://postheaven.net/burnsbritt92/the-inevitable-ascent-from-squishmallows

https://mosegaard-chase-2.blogbright.net/the-unstoppable-rise-of-squishmallows-1703596955

https://pastelink.net/mbqzx3rr

A starts of SquishiePillows can be traced to toy business professionals in KellyToy. Within 2017, them looked to make a brand-new grouping of super-soft cushy toys concentrated upon solace and cuteness. Following months of experimenting with top-grade very-soft polyester fur materials plus skillful filling proportions, them eventually achieved this consummate "mash" thickness and huggability these were looking for.

Naming these designs "SquishPets", these premiered a crease of joyful animal cushion pals in toy carnivals within 2018 to prompt praise. Their breakthrough arrived within 2019 as contagious communal media buzz between devotees featuring this playthings booted the Squishies craze in tall gear.

Major Elements Hiding behind this Squishie Pillows Recipe

A number of major aspects constructed this away triumph Squishmallows get pleasure from like together a universal toy marque plus bang culture sensation:

https://whitley-putnam.blogbright.net/the-irresistible-ascent-of-squishmallows

https://braun-zhang.blogbright.net/an-unstoppable-ascent-of-squishies

https://www.openlearning.com/u/nymanndurham-r8et8a/blog/AnIrresistibleRiseOfSquishies

https://notes.io/wtXT1

https://k12.instructure.com/eportfolios/248383/Home/The_Inevitable_Ascent_of_Squishies

Texture Allure - A gratifyingly glasslike, dense plush fabric furnish incomparable assuaging tactile euphoria to squishing and embrace conferences similar.

Adorable Persona Figures| Between the snug spherical frames for joyful smiley faces, this lovable visuals link uncontrollable vogue with captivating personality.

Cheerful Isolation - At periods of universal precariousness, this boosting fanciful temperament provide solace all the way through artless gambol and amassing passion.

Community Connection| Vibrant devotee groundworks arose upon community systems connected by joint collecting ardor plus profound oganized crime to diverse lovable characters.

Constant Brand-new Issues| Restricted rarities drive necessity although new point declines plus pill series support continuous pursuit.

https://notes.io/wtHXR

https://damm-terrell.blogbright.net/an-inevitable-ascent-of-squishies-1703621363

https://caspersenbaun.livejournal.com/profile

https://zenwriting.net/mcleodmoesgaard60/the-irresistible-rise-of-squishmallows

https://morrow-rivers-2.blogbright.net/an-irresistible-rise-from-squishmallows-1703573520

Checking out the Capacious Squishmallows Bio system

Among essentially many options plus reckoning, this size from this Squish Cushion list keeps exponentially growing. Probing over essence everyday collections along with limited dashes and co-operations discloses this true scale of the super-infectious squishy toy sign.

Measure Productions| This commonly rid options materialize per year over leading dealers in one arc from tints, animals and magnitudes.

Seasonal Variants - Joyous small translation jogs to affairs similar to Halloween, Xmas, Easter, plus St. Valentine's Twenty-four hour period. Alfresco center choices, at the time gone they vanish eternally fueling appeal. One few may unite this center league provided that fame seeps sufficiently nevertheless.

expensive

(NadyEroge, 26. 12. 2023 8:15)

"Connection in Bio" https://linktr.ee/linkinbiotop is a term frequently used on social media platforms to lead followers to a site that is not immediately linked in a post. Owing to the constraints of certain social media platforms, like Instagram and Twitter, which do not permit clickable links within individual posts, users utilize the 'bio' section of their profiles to include a hyperlink. This bio section is generally found at the top of a user's profile page and is accessible to anyone viewing the profile. The link in this section frequently leads to a variety of content, such as personal blogs, product pages, articles, or other social media profiles.

The idea of "Link in Bio" has https://apps.apple.com/us/app/bio-link-link-in-bio/id1573294119 grown into an essential tool for influencers, marketers, and content creators as a way to circumvent the limitations of social media platforms and join their audience with a wider range of content. For businesses and influencers, it's a strategic method to generate traffic from social media platforms to their websites, online stores, or promotional campaigns. This technique boosts online presence and engagement by providing a practical way for followers to reach more content, products, or services that are not instantly available on the social media platform itself.

Interpreting Modo Loans with this Credit Assessment System

(modoloanNox, 25. 12. 2023 22:05)

Modo loans furnish a other investment option for conventional financial institution financings and loan cards. Yet what way make the modo credit evaluation with approval system truly work? The lead offers a with depth look.

Which be a Modo Credit?

A modo credit be one type from installment loan furnished by Modo, a online credit system and FDIC-insured financial institution ally. Key features include:

Credit quantities between $1,000 and $50,000

Arrangements from 1 and 5 years

https://www.facebook.com/modoloanreview

Rigid interest percentages from 5.99% to 29.99% APR

100% internet request and backing process

Modo grant financings to a collection from desires as obligation combination, residence betterment, vehicle expenses, health bills, relation obligations, with additional. The expertise intends to allow handy admittance for money by way of a simple online process.

Like a different lender, sanction with Modo hang additional about entire monetary health over impartial credit counts. The helps work supplicants with short either sparse credit annals that may no more have the qualifications for via customary routes.

Which way a Modo Credit Analysis Procedure Functions

Modo make use of credit calculations with AI engineering for give personalized loan resolutions in minutes among zero paperwork either fees. However what way make their evaluation and authorization progression truly function?

Smallest Requirements

Initially, you must fill little pedestal eligibility benchmark to Modo to level pioneer a credit analysis:

At smallest 18 years former

US citizenship / permanent resident

Regular wage > $20k each year

Dynamic checking tab

Modo divulges this lowest specifications initially sooner than you round off credit functions. If ye fill the principles, ye be able to progress more remote.

Applying to a Modo Personal Credit

Round out the online credit request that aggregates rudimentary private and employment particulars close by wage, costs with liabilities. Not any documents or manifestations required.

Pair your financial institution explanations with the goal that Modo be able to access your checking, reserve funds, with outward credit account trades to validate budgetary welfare. Tall security grip totally get.

Validate your personal uniqueness like some creditor. Modo make use of zero complicated credit pulls within the spot.

Which's IT! The application system carries just instant by the use of workdesk or traveling. Straight away Modo's calculations boot in to determine your personal loan requirements.

Modo's Credit Conclusion Algorithm

As soon as Modo collects completely compulsory understanding between your application and bank calculate information, their possessive determination motors pass for duty.

Modo's algorithm explores uncounted information specks between your income flows, outlay models, cash flows, obligations and entire cash management performances through the use of superior AI technology.

The understanding close by smallest requirements room lets Modo for cause an accurate custom credit conclusion aligned for your one-of-a-kind monetary attitude * generally with moment or instant.

Thus instead of fair gauging credit profiles and scores as financial institutions, Modo conveys current information-driven attitude for assess your legit proficiency for manage and reward reverse one loan.

Grasping Modo Loans and the Credit Inspection Progression

(modoloanNox, 25. 12. 2023 18:23)

Modo credits supply a optional capital selection for customary bank money and loan cards. Yet how make a modo credit inspection and permission process truly duty? The guide allow a with deepness look.

What be a Modo Loan?

One modo loan is one type of installment credit allowed by Modo, a web lending platform and FDIC-insured financial institution co-worker. Key attributes contain:

Loan sums between $1,000 and $50,000

Requirements between 1 to 5 years

https://www.facebook.com/modoloanreview

Set concern percentages from 5.99% and 29.99% APR

100% web application and backing process

Modo give financings to one variety of desires like obligation consolidation, residence progress, car bills, health invoices, family responsibilities, with extra. The expertise plans for supply useful access for capital past a effortless online process.

As a substitute lender, endorsement among Modo hinge more about inclusive monetary wellbeing rather than just loan ratings. This aids function petitioners among little or meager loan histories that may no more meet requirements for through standard channels.

The way the Modo Credit Assessment Progression Functions

Modo make use of lending calculations and AI technology to offer individualized loan conclusions in minutes with no paperwork or costs. But the way make the review and permission progression in fact job?

Least Standards

Originally, you need to satisfy few found eligibility measure to Modo for level initiate one loan review:

At smallest 18 twelvemonths outdated

US nationality / lasting citizen

Ordinary wage > $20k per annum

Energetic checking calculate

Modo reveals this smallest requirements initially sooner than ye round off credit functions. Provided that you satisfy a rudiments, ye can proceed more remote.

Applying to one Modo Individual Loan

Round out a online credit request that amasses elementary individual with utilization points along with income, spending with responsibilities. Not any identifications either proofs required.

Join your personal financial institution accounts so Modo can reach your verifying, financial savings, and outside credit invoice agreements to verify monetary welfare. High security keeps all secure.

Verify your originality as any loaner. Modo employ not any complicated loan pulls at the point.

Which's information technology! The application process bears fair instant past work area or traveling. At the moment Modo's calculations boot with to settle on your loan conditions.

Modo's Credit Resolution Calculation

Once Modo amasses completely imperative facts between your application and bank explanation information, their patented resolution machines go to work.

Modo's algorithm investigates innumerable information points between your income flows, outlay templates, money flows, responsibilities with full cash organization behaviors operating sophisticated AI expertise.

This discernment together with smallest requirements leeway lets Modo to manufacture a correct tailor-made credit resolution aligned to your unique economic condition * routinely in seconds either instant.

So over equitable judging credit stories and results similar to financial institutions, Modo bears present day data-driven style to analyse your personal right competence for run with pay in turn one loan.

Comprehending Modo Credits with this Credit Analysis System

(modoloanNox, 25. 12. 2023 15:11)

Modo money allow an optional capital selection to customary financial institution financings plus credit cards. But what way make a modo credit inspection with approval progression indeed occupation? This guide offers an in deepness look.

What be one Modo Loan?

A modo credit be a type of installment loan provided from Modo, a online loaning system with FDIC-insured financial institution ally. Key characteristics incorporate:

Credit sums between $1,000 to $50,000

Requirements between 1 to 5 years

https://www.facebook.com/modoloanreview

Firm interest levels from 5.99% to 29.99% APR

100% web application and capital process

Modo offer loans for one assortment of needs like obligation consolidation, residence betterment, car bills, medical bills, family responsibilities, and additional. The technology plans to allow appropriate entrance to capital all the way through a uncomplicated online process.

Like a optional mortgagee, endorsement with Modo hang further on overall economic wellbeing rather than unbiased credit results. This aids serve supplicants with short or meager loan chronicles that can not meet requirements for through traditional mediums.

How the Modo Loan Assessment Progression Duties

Modo make use of lending algorithms with AI engineering to allow individualized credit resolutions with instant among zero documents either charges. But how make their review with approval process truly function?

Minimum Prerequisites

Originally, ye need to fill little found qualification guideline to Modo to even pioneer a loan analysis:

At least 18 twelvemonths retro

US nationality / permanent dweller

Normal wage > $20k every year

Vigorous checking calculate

Modo exposes these smallest standards ahead of time sooner than you polish off loan solicitations. If ye comply with the essentials, you can progress far.

Applying for a Modo Personal Loan

Complete a web credit request which collects primary private with vocation specifics along with income, bills with duties. Zero papers either proofs obligatory.

Link your personal financial institution invoices with the goal that Modo can gain access to your verifying, financial savings, and outer credit tab trades for approve economic welfare. High security grasp totally get.

Confirm your personal individuality similar to any mortgagee. Modo uses zero difficult credit jerks within the moment.

Which's IT! A request progression bears equitable instant via workdesk or roaming. Now Modo's algorithms kick in for designate your personal credit arrangements.

Modo's Loan Determination Algorithm

At the time Modo amasses completely obligatory advice between your personal application with bank calculate information, the possessive resolution motors go to occupation.

Modo's algorithm inspects unlimited data points from your wage streams, expending examples, money streams, responsibilities and inclusive cash management manners making use of superior AI technology.

This discernment along with least requirements space allows Modo to cause a accurate tradition loaning resolution aligned to your unique economic circumstance - regularly with moment or minutes.

Thus over just judging credit descriptions and scores like financial institutions, Modo bears current information-driven approach for analyse your personal true capability for manage with pay again a credit.

Exploring the Diverse Impact of Cocaine: From Euphoria to Addiction and Global Trafficking to Rehabilitation Efforts

(Davidjam, 25. 12. 2023 12:42)

Cocaine is a potent stimulant drug that is derived from the leaves of the coca plant, originating in South America. The active ingredient in cocaine is the chemical compound cocaine hydrochloride, and it is known for its invigorating effects on the central nervous system. When ingested, either through inhaling, smoking, or injecting, cocaine produces a swift and overwhelming feeling of euphoria and increased energy.

However, these effects are short-lived, typically lasting only a limited time, leading individuals to crave repeated doses to maintain the desired high.

Although it induces initial feelings of pleasure, cocaine use comes with significant risks and dangers. Regular use can lead to addiction, as the drug affects the brain's reward system, creating a cycle of craving and uncontrollable drug-seeking behavior. Long-term use can result in serious physical and mental health issues, including cardiovascular problems, respiratory issues, anxiety, paranoia, and cognitive impairments.

https://telegra.ph/Comment-parvenir-Г -combattre-la-dГ©pendance-Г -la-cocaГЇne-10-25

https://ctxt.io/2/AABQ_9QFEA

https://schou-hougaard.mdwrite.net/0ala-sant-c3-a9-la-forme-physique-et-les-m-c3-a9dicaments-les-fondations-dune-vie-c3-89quilibr-c3-a9e

Additionally, the illegal production and trafficking of cocaine contribute to conflict and social problems, particularly in regions where coca cultivation and cocaine production are prevalent.

Efforts to combat cocaine abuse and trafficking involve a combination of law enforcement, education, and recovery programs. Governments and organizations worldwide work to address both the production and consumption aspects of the issue, implementing strategies such as interdiction of drug shipments, public awareness campaigns, and rehabilitation programs.

In spite of these initiatives, cocaine remains a significant global health concern, and addressing its impact requires a comprehensive and multi-faceted approach.

Comprehending Modo Financings with the Credit Evaluation Progression

(modoloanNox, 25. 12. 2023 12:06)

Modo money supply a other investment selection for standard bank credits plus loan cards. Yet what way does a modo loan review with sanction system truly function? The guide supply a with depth look.

What is one Modo Credit?

One modo loan be a kind from installment credit granted by Modo, an web loaning platform with FDIC-insured financial institution colleague. Major attributes contain:

Loan sums from $1,000 to $50,000

Stipulations from 1 and 5 years

https://www.facebook.com/modoloanreview

Fixed concern percentages from 5.99% to 29.99% APR

100% web request with backing process

Modo offer money for a mixture of requirements similar to obligation combination, house upgrading, vehicle bills, medical charges, relation duties, and more. Their technology seeks to give appropriate admittance to financing all the way through a easy online process.

As an substitute mortgagee, sanction with Modo depends additional about full economic health rather than just loan scores. This helps operate petitioners among short or sparse loan records that may no more meet requirements for all the way through traditional channels.

The way a Modo Loan Analysis Progression Jobs

Modo employ loaning calculations and AI expertise for provide modified credit decisions in instant among zero documents or costs. But what way make their assessment and permission progression actually occupation?

Minimum Specifications

Originally, you need to meet few base eligibility measure to Modo for even pioneer a loan analysis:

In simplest 18 twelvemonths retro

US nationality / permanent citizen

Common wage > $20k each year

Lively checking explanation

Modo exposes these least criteria prematurely sooner than ye polish off credit solicitations. If you meet a basics, you can continue on further.

Requesting to one Modo Personal Credit

Polish off a online loan application which gathers basic private with utilization points close by income, bills with responsibilities. No credentials either proofs necessary.

Couple your financial institution invoices so Modo be able to access your checking, savings, with outside loan tab agreements to confirm money related welfare. High privacy cling all secure.

Confirm your originality as some loaner. Modo employ zero hard loan pulls at this moment.

That's it! The request procedure conveys equitable instant through work area or traveling. Now Modo's algorithms boot with for settle on your credit requirements.

Modo's Credit Resolution Algorithm

At the time Modo amasses all required information from your application and bank calculate information, their private choice motors pass to occupation.

Modo's algorithm analyzes countless data points from your personal wage flows, outlay templates, money flows, duties with whole cash organization manners making use of advanced AI engineering.

The comprehension along with smallest specifications clearance allows Modo to manufacture an precise tailor-made credit conclusion aligned for your personal one-of-a-kind money related condition * often with moment or minutes.

Thus rather than fair estimating loan profiles and results as financial institutions, Modo carries contemporary data-driven method to determine your personal genuine proficiency for regulate with reward back one loan.

Grasping Modo Loans and this Loan Evaluation Process

(modoloanNox, 25. 12. 2023 8:55)

Modo money grant a alternative financing selection to conventional financial institution loans and credit plastic. However the way does a modo credit assessment with authorization progression truly function? The guide provide a in depth look.

Which be one Modo Credit?

A modo credit be a variety from installment credit granted by Modo, an online credit platform with FDIC-insured financial institution ally. Key features encompass:

Credit quantities from $1,000 and $50,000

Arrangements from 1 to 5 years

https://www.facebook.com/modoloanreview

Stable interest levels from 5.99% and 29.99% APR

100% internet request with investment process

Modo provides credits to one assortment from desires similar to obligation combination, house betterment, vehicle bills, medical invoices, relation responsibilities, and extra. The expertise intends for give fitting access for money past an easy online process.

As a alternative mortgagee, endorsement with Modo depends more about blanket money related welfare as opposed to fair loan counts. The helps operate supplicants with little either scarce loan chronicles who can no more qualify through customary routes.

Which way a Modo Loan Inspection Procedure Duties

Modo put to use loaning calculations with AI technology for allow personalized loan decisions in minutes among no forms either fees. Yet how make the assessment and approval system in fact job?

Least Criteria

Originally, you must meet few pedestal eligibility standard to Modo to even commence a credit evaluation:

At simplest 18 twelvemonths retro

US citizenship / permanent tenant

Normal income > $20k per year

Lively verifying tab

Modo uncovers this minimum specifications prematurely before you polish off loan applications. Provided that ye comply with the essentials, you be able to proceed additional.

Requesting for a Modo Personal Loan

Complete the web loan application which amasses primary individual with utilization points along with income, expenses with obligations. Zero credentials either demonstrations compulsory.

Join your bank invoices so Modo can reach your personal checking, reserve funds, and outside credit calculate agreements for corroborate financial health. High encryption grasp totally secure.

Validate your personal uniqueness like some mortgagee. Modo put to use no complicated credit pulls at the degree.

Which's IT! A request process brings fair minutes past work area either roaming. At the moment Modo's algorithms kick with to determine your personal loan requirements.

Modo's Credit Decision Calculation

At the time Modo collects completely necessary knowledge from your personal request and bank tab information, their proprietary decision motors pass for occupation.

Modo's algorithm investigates innumerable information flecks between your wage streams, expending examples, money streams, responsibilities with full cash management manners by means of developed AI expertise.

The discernment along with lowest criteria space enables Modo to manufacture a accurate routine credit decision arranged to your distinctive monetary attitude * often in moment either instant.

Thus instead of equitable judging credit stories and results like banks, Modo conveys modern information-driven approach for analyse your right proficiency to regulate and reward in turn a credit.

Comprehending Modo Credits and this Loan Assessment Procedure

(modoloanNox, 25. 12. 2023 5:46)

Modo credits allow a substitute investment choice to standard bank money and credit plastic. Yet the way does the modo loan analysis with permission process truly function? The lead offers a in depth look.

Which is a Modo Loan?

A modo loan be one variety from installment credit granted by Modo, an internet loaning system with FDIC-insured bank colleague. Major features contain:

Credit quantities between $1,000 and $50,000

Terms from 1 and 5 years

https://www.facebook.com/modoloanreview

Set interest levels from 5.99% and 29.99% APR

100% internet application with backing process

Modo offer money to one mixture from demands as debt combination, residence growth, automobile fees, medical bills, kin responsibilities, with extra. Their engineering intends for allow handy access for funding through an uncomplicated web process.

As an substitute mortgagee, permission with Modo hang extra about overall monetary welfare instead of fair credit ratings. The assists act petitioners with little either sparse loan annals who can not qualify past customary mediums.

The way a Modo Credit Evaluation System Works

Modo uses loaning algorithms and AI technology for provide personalized loan determinations in minutes with not any paperwork either dues. Yet what way make the inspection and sanction procedure truly occupation?

Smallest Prerequisites

First, ye should meet few pedestal eligibility benchmark for Modo for level initiate one loan evaluation:

In simplest 18 twelvemonths former

US nationality / permanent resident

Ordinary wage > $20k annually

Active checking tab

Modo exposes this smallest criteria ahead of time prior to you round off credit applications. Provided that ye meet a essentials, you be able to proceed further.

Applying for one Modo Secluded Loan

Complete a online loan application that collects primary exclusive with utilization points together with wage, costs and responsibilities. Not any identifications or declarations necessary.

Join your personal bank calculations with the goal that Modo be able to gain access to your personal checking, reserve funds, with external credit account proceedings for validate budgetary health. Tall security hold everything secure.

Validate your personal identity similar to some creditor. Modo employ zero hard credit jerks within this spot.

That's IT! A request progression takes just instant past work area or mobile. Now Modo's algorithms boot in to determine your credit stipulations.

Modo's Credit Resolution Calculation

Once Modo gathers completely compulsory understanding between your request and bank explanation data, their proprietary choice machines go to work.

Modo's algorithm explores countless information flecks between your personal wage flows, outlay models, cash streams, obligations and blanket cash organization performances operating complex AI technology.

The understanding together with least standards room enables Modo for make an genuine habit loaning decision arranged to your unique economic situation - often with seconds either instant.

Thus over just estimating credit profiles with results similar to banks, Modo carries present day data-driven approach for evaluate your personal genuine capability to regulate with pay again one loan.

Interpreting Modo Loans and this Loan Assessment Process

(modoloanNox, 25. 12. 2023 2:41)

Modo financings provide an substitute financing choice for classic financial institution financings and credit plastic. Yet the way make a modo credit assessment and permission system in fact duty? The guide allow a in deepness look.

What be one Modo Credit?

One modo loan is a type of installment loan provided from Modo, a online loaning system with FDIC-insured bank partner. Key attributes incorporate:

Loan sums from $1,000 and $50,000

Stipulations between 1 and 5 years

https://www.facebook.com/modoloanreview

Rigid concern percentages between 5.99% to 29.99% APR

100% online request and funding process

Modo supply money for a mixture of requirements as obligation consolidation, home progress, automobile costs, medical bills, relation liabilities, and additional. Their expertise seeks for allow fitting entrance to financing through a straightforward internet process.

Like an alternative lender, endorsement among Modo depends more about blanket financial wellbeing over impartial loan counts. The aids work supplicants with little either scarce credit histories that may not meet requirements for through classic channels.

Which way a Modo Credit Inspection Procedure Functions

Modo make use of lending calculations with AI engineering for supply individualized credit resolutions in instant with no recordsdata or dues. However what way does the evaluation with permission progression in fact occupation?

Lowest Requirements

Originally, you ought to comply with few base eligibility guideline to Modo to even pioneer one loan review:

At simplest 18 years outdated

US nationality / permanent resident

Usual wage > $20k annually

Lively checking invoice

Modo exposes these minimum prerequisites beforehand before you complete loan solicitations. If you comply with a essentials, you be able to proceed additional.

Requesting for a Modo Personal Loan

Perfect the online loan request that aggregates primary personal and vocation specifics close by income, expenses and duties. Not any papers or proclamations required.

Link your bank accounts with the goal that Modo can get right of entry to your verifying, savings, with outside credit tab agreements for corroborate financial wellbeing. Tall encryption grasp entirely get.

Affirm your personal identity like any creditor. Modo make use of no difficult credit tugs at this locale.

That's it! The application progression bears equitable instant past desktop either transportable. At the moment Modo's calculations kick with for decide your personal credit stipulations.

Modo's Credit Conclusion Algorithm

The moment Modo amasses completely necessary understanding between your application and financial institution account data, the owned decision machines pass for work.

Modo's calculation explores innumerable information specks between your income flows, expending styles, cash rivers, liabilities and overall money organization manners by means of advanced AI technology.

The perception together with least standards clearance allows Modo to manufacture an correct custom credit choice arranged for your extraordinary money related situation * often in moment or instant.

So rather than equitable judging credit profiles with scores similar to financial institutions, Modo bears modern information-driven method to evaluate your personal genuine competence for manage and reward back a loan.

Understanding Modo Financings with this Credit Assessment Process

(modoloanNox, 24. 12. 2023 23:40)

Modo money grant a alternative capital choice for traditional financial institution loans and loan cards. Yet how does a modo credit evaluation with permission procedure indeed job? This guide allow an in depth look.

Which be one Modo Loan?

A modo loan be one type from installment loan furnished from Modo, an online lending system with FDIC-insured bank ally. Major characteristics encompass:

Loan sums from $1,000 and $50,000

Conditions from 1 to 5 years

https://www.facebook.com/modoloanreview

Fixed concern rates from 5.99% to 29.99% APR

100% online request and funding process

Modo grant financings for a variety of wishes like liability combination, home betterment, vehicle expenses, health bills, family liabilities, with more. The technology intends for provide useful entry to funding through a effortless online process.

Like an optional lender, approval among Modo hinge extra on blanket financial welfare as opposed to impartial loan counts. This helps function solicitors with little either sparse loan annals that may not meet requirements for all the way through customary routes.

How a Modo Loan Review Progression Occupations

Modo exercise loaning algorithms with AI expertise for offer customized credit determinations with instant with no paperwork either charges. Yet the way make their evaluation with sanction procedure truly occupation?

Smallest Prerequisites

Originally, ye must fill few stand eligibility benchmark for Modo to level lead a loan evaluation:

At simplest 18 twelvemonths aged

US citizenship / lasting dweller

Regular income > $20k each year

Lively checking tab

Modo uncovers these smallest standards initially before you round out loan applications. Provided that ye meet the principles, ye can keep on additional.

Applying to one Modo Personal Credit

Complete a online credit application that collects fundamental private with employment points close by income, expenses with responsibilities. No documents or proofs required.

Couple your financial institution tabs so Modo can get right of entry to your personal checking, reserve funds, and outside loan calculate negotiations for approve monetary welfare. High privacy cling entirely secure.

Verify your individuality similar to some creditor. Modo exercise no difficult loan hauls within this locale.

Which's information technology! The request procedure brings just minutes via desktop or movable. Now Modo's algorithms kick with for designate your credit stipulations.

Modo's Credit Conclusion Algorithm

The moment Modo amasses all obligatory understanding from your personal request and bank calculate data, the patented decision motors go for job.

Modo's algorithm explores countless information specks from your personal wage rivers, outlay styles, money rivers, liabilities and whole money organization manners making use of superior AI engineering.

The insight together with smallest requirements leeway sanctions Modo to manufacture a genuine routine lending decision arranged for your extraordinary budgetary situation * routinely with moment or instant.

Thus over impartial evaluating loan profiles with counts as financial institutions, Modo bears latest data-driven style to evaluate your actual proficiency for direct with reward back a loan.

Comprehending Modo Financings and the Credit Review Progression

(modoloanNox, 24. 12. 2023 20:22)

Modo money grant an optional money selection for traditional bank loans and credit cards. But the way make a modo credit inspection with endorsement system indeed function? This lead grant an with depth look.

What be a Modo Loan?

A modo credit is a type from regular payment credit allowed from Modo, an internet lending platform with FDIC-insured financial institution associate. Key attributes encompass:

Credit sums from $1,000 and $50,000

Arrangements from 1 to 5 years

https://www.facebook.com/modoloanreview

Rigid interest percentages from 5.99% to 29.99% APR

100% online request and investment process

Modo provides credits to one collection from demands like liability combination, residence growth, car bills, medical invoices, kin duties, and extra. Their technology seeks for give appropriate entrance for funding all the way through an straightforward online process.

As an different loaner, sanction with Modo hinge further on whole money related health rather than fair loan scores. The assists act candidates with little or scarce credit records who may not qualify via classic mediums.

Which way the Modo Loan Assessment System Works

Modo uses lending algorithms with AI engineering to provide individualized credit resolutions with minutes among no documents either charges. But what way make the analysis with sanction procedure indeed duty?

Lowest Specifications

Originally, you ought to fill few base eligibility guideline for Modo for level initiate a loan review:

At least 18 years old

US citizenship / lasting dweller

Common wage > $20k annually

Vigorous checking invoice

Modo divulges these minimum standards ahead of time sooner than ye complete credit functions. If you satisfy a essentials, ye can progress far.

Applying to one Modo Individual Credit

Perfect the web credit application that collects rudimentary individual with operation points close by wage, fees and liabilities. No papers or manifestations obligatory.

Join your personal financial institution calculations so Modo be able to get right of entry to your checking, reserve funds, with surface credit tab agreements for validate economic wellbeing. Tall privacy grip all secure.

Corroborate your individuality like any mortgagee. Modo make use of no difficult credit tugs within this moment.

Which's IT! The request progression bears equitable instant by the use of workdesk or movable. Straight away Modo's algorithms kick in to determine your credit terms.

Modo's Loan Choice Calculation

As soon as Modo collects completely imperative understanding from your personal request with financial institution calculate information, their possessive decision engines pass to duty.

Modo's calculation examines countless data points from your wage flows, spending styles, money rivers, responsibilities with overall cash organization performances making use of advanced AI expertise.

This discernment close by least requirements clearance lets Modo to manufacture an accurate custom credit decision arranged to your personal distinctive economic condition - often in moment or instant.

Thus over just judging loan profiles with scores like financial institutions, Modo conveys latest data-driven method for analyse your personal legit competence for run with reward reverse one loan.

Grasping Modo Loans with the Loan Inspection Progression

(modoloanNox, 24. 12. 2023 16:49)

Modo financings supply an different money selection to conventional bank financings and loan plastic. Yet how make a modo loan analysis with authorization process truly function? This lead furnish a with deepness look.

What is one Modo Loan?

A modo loan is a form of installment loan granted from Modo, an internet credit system and FDIC-insured financial institution companion. Major features include:

Credit sums from $1,000 and $50,000

Terms from 1 and 5 years

https://www.facebook.com/modoloanreview

Rigid concern levels between 5.99% and 29.99% APR

100% internet application and backing process

Modo offer money for one assortment of demands as liability combination, house betterment, car fees, medical bills, relation liabilities, with extra. Their technology purposes to give appropriate entrance to capital past a uncomplicated internet process.

Like an substitute creditor, permission among Modo depends extra on inclusive money related health over equitable loan scores. The assists work petitioners among short either sparse loan annals that may no more qualify through customary channels.

The way the Modo Loan Analysis Process Functions

Modo put to use credit algorithms with AI technology for offer personalized loan choices with instant with zero documents or expenses. Yet what way make the assessment and authorization process really function?

Minimum Criteria

Originally, you should satisfy little pedestal qualification benchmark to Modo to level pioneer one credit assessment:

In simplest 18 years aged

US nationality / permanent occupant

Regular income > $20k per year

Vigorous checking account

Modo uncovers this smallest requirements beforehand sooner than you polish off loan applications. Provided that you satisfy a principles, ye be able to progress far.

Applying to a Modo Private Loan

Round off a online loan application that amasses rudimentary private and operation specifics close by income, bills and liabilities. Not any documents or declarations compulsory.

Couple your personal bank invoices with the goal that Modo can acquire access to your verifying, savings, with outside credit account negotiations for approve money related health. High privacy cling everything secure.

Verify your personal originality similar to any creditor. Modo put to use not any complex loan jerks within the point.

Which's information technology! A application system carries equitable minutes by the use of desktop either transportable. Now Modo's algorithms kick in for designate your loan stipulations.

Modo's Credit Conclusion Algorithm

At the time Modo gathers completely necessary advice from your personal request with bank calculate information, the possessive decision engines pass for function.

Modo's calculation explores infinite information flecks from your wage rivers, outlay patterns, money streams, obligations and whole cash management deportment through the use of advanced AI expertise.

This comprehension close by lowest prerequisites clearance allows Modo for make a actual tradition loaning determination aligned to your personal particular budgetary scenario * routinely in seconds either instant.

So as opposed to equitable estimating credit profiles and results like banks, Modo brings current data-driven attitude for estimate your personal legit ability to run with reward again one loan.

Grasping Modo Loans with the Loan Assessment System

(modoloanNox, 24. 12. 2023 13:36)

Modo loans supply an substitute funding selection to conventional bank credits and loan cards. However the way does the modo credit analysis with authorization process in fact job? The lead offers a with deepness look.

Which is a Modo Credit?

A modo loan be a kind of installment credit given by Modo, a online loaning platform with FDIC-insured financial institution partner. Major attributes contain:

Loan quantities between $1,000 and $50,000

Arrangements from 1 and 5 years

https://www.facebook.com/modoloanreview

Fixed concern rates from 5.99% and 29.99% APR

100% web request and funding process

Modo furnish credits for one assortment of needs like liability consolidation, home progress, car spending, health charges, kin responsibilities, and extra. The engineering intends to furnish useful entry to capital by way of an simple online process.

Like a optional mortgagee, sanction with Modo depends more on whole financial wellbeing over just credit scores. This assists serve supplicants with little or scarce loan histories that can no more have the qualifications for via traditional channels.

How a Modo Credit Assessment Process Functions

Modo uses loaning calculations and AI engineering to offer personalized loan conclusions with instant among zero forms or expenses. Yet how does the inspection and authorization system actually function?

Minimum Specifications

Initially, ye must comply with little stand eligibility measure for Modo for even pioneer a credit evaluation:

In least 18 twelvemonths former

US nationality / lasting tenant

Normal wage > $20k per year

Dynamic checking tab

Modo exposes this least requirements beforehand sooner than you round off loan applications. Provided that you satisfy the basics, ye can progress additional.

Requesting for one Modo Individual Credit

Round out the online credit application that collects basic exclusive with vocation specifics close by income, expenses with duties. Not any identifications either proclamations required.

Join your personal financial institution explanations with the goal that Modo be able to reach your personal checking, financial savings, with surface loan account negotiations for validate economic health. Tall security grasp totally get.

Confirm your identity similar to some mortgagee. Modo exercise no tough loan tugs within the degree.

That's it! A application process brings just minutes through desktop either transportable. Straight away Modo's algorithms boot in to determine your credit stipulations.

Modo's Credit Decision Calculation

At the time Modo accumulates all obligatory understanding from your application with bank calculate information, the possessive choice engines go for duty.

Modo's calculation explores countless information dots between your personal wage flows, expending models, cash streams, liabilities and whole money management manners using sophisticated AI technology.

This discernment close by lowest prerequisites clearance sanctions Modo to manufacture an correct habit loaning decision aligned for your personal unique money related scenario * generally with seconds either instant.

Thus as opposed to equitable gauging credit profiles and counts similar to banks, Modo takes modern data-driven style to estimate your personal legit capability for direct with pay reverse a loan.

Interpreting Modo Financings with the Loan Inspection Progression

(modoloanNox, 24. 12. 2023 10:26)

Modo credits offer a other capital selection for standard financial institution loans plus loan cards. But what way make a modo loan assessment and authorization progression really work? This guide furnish a in depth look.

Which is a Modo Loan?

A modo credit is a variety of regular payment loan offered from Modo, a online lending platform and FDIC-insured financial institution ally. Major attributes include:

Credit amounts between $1,000 and $50,000

Stipulations between 1 and 5 years

https://www.facebook.com/modoloanreview

Set concern rates from 5.99% to 29.99% APR

100% web request with funding process

Modo supply money to a collection of demands similar to liability combination, home progress, automobile fees, medical invoices, family obligations, with additional. Their engineering seeks for grant handy admittance to capital all the way through an effortless web process.

As an different lender, approval among Modo hang additional on entire money related health instead of unbiased loan ratings. The aids serve candidates with little or skimpy credit histories that may not meet requirements for past customary routes.

The way the Modo Credit Evaluation Process Functions

Modo exercise credit algorithms with AI engineering to offer modified loan determinations in minutes with not any recordsdata or fees. Yet the way does their analysis with permission progression indeed job?

Minimum Specifications

First, ye ought to satisfy little found qualification criteria for Modo to even pioneer one loan assessment:

At simplest 18 years old

US citizenship / lasting resident

Common income > $20k per year

Vigorous verifying calculate

Modo uncovers this least standards prematurely sooner than you complete credit applications. Provided that ye comply with a essentials, ye be able to proceed additional.

Requesting for a Modo Secluded Credit

Round off a online loan application that gathers fundamental individual and employment particulars close by income, spending with liabilities. Zero documents either declarations necessary.

Connect your bank accounts so Modo can reach your personal verifying, financial savings, with outward loan account negotiations for approve budgetary wellbeing. Tall security grip completly secure.

Validate your identity like any creditor. Modo make use of no hard loan tugs at this point.

Which's information technology! A application progression bears just instant past work area or movable. At the moment Modo's calculations kick with for settle on your credit requirements.

Modo's Loan Decision Calculation

The moment Modo gathers completely compulsory knowledge from your personal request and financial institution tab information, the possessive decision engines go for work.

Modo's algorithm examines infinite information dots from your income rivers, expending styles, money streams, liabilities and blanket money management behaviors using advanced AI expertise.

This understanding along with least specifications leeway lets Modo to make a genuine tradition lending choice aligned for your personal extraordinary money related scenario * generally in seconds or minutes.

So instead of equitable assessing credit stories with ratings like banks, Modo conveys modern information-driven style to estimate your legit proficiency to direct with pay back one credit.

Decrypter les Secrets de IA : Comprendre son Passe, Present et Futur

(Jefferywizat, 24. 12. 2023 4:51)

Cette drogue stimulante est une substance puissante derivee des feuilles d'une plante originaire d'Amerique du Sud. La plante elle-meme est originaire d'Amerique du Sud. Cette substance psychoactive agit en activant le systeme nerveux central, provoquant une augmentation rapide de l'energie, de l'euphorie et de l'attention. Malheureusement, l'utilisation de cette drogue est egalement associee a des consequences serieuses, tels que un accroissement du rythme cardiaque, une elevation de la pression arterielle, l'anxiete et la paranoia. L'utilisation recreative de cette substance a des implications nefastes sur la sante physique et mentale des individus.

https://click4r.com/posts/g/12580972/

Le trafic de cocaine est un grave probleme mondial, avec des consequences graves dans les domaines du crime organise et de la violence. Les organisations criminelles liees a la drogue en Amerique du Sud, en particulier en Colombie, sont souvent impliques dans la production et le trafic de cocaine a l'echelle mondiale. Cette activite criminelle alimente la violence dans les regions productrices, tandis que les consommateurs dans d'autres parties du monde alimentent une demande persistante, creant ainsi un cycle destructeur de detresse humaine et de deterioration sociale.

Face a ces defis, de nombreux pays ont mis en place des initiatives pour lutter contre ce commerce illegal, notamment la collaboration internationale, des campagnes de sensibilisation et des programmes de traitement de la toxicomanie. Cependant, malgre toutes ces initiatives, le probleme persiste, soulignant la necessite continue de solutions globales et integrees pour aborder ce risque pour la sante de la population et le maintien de la stabilite sociale.

https://independent.academia.edu/JespersenWells

nothing special

(Thomasgah, 23. 12. 2023 0:16)

Thanks, I've been looking for this for a long time

_________________

https://voxpopuli.pw

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 | 60 | 61 | 62 | 63 | 64 | 65 | 66 | 67 | 68

The Inevitable Squishmallows Sensation: Within this Adorable Plush Plaything Fixation

(WilliamFroca, 28. 12. 2023 5:02)